Five Star Grew from the Trees of Early County Georgia

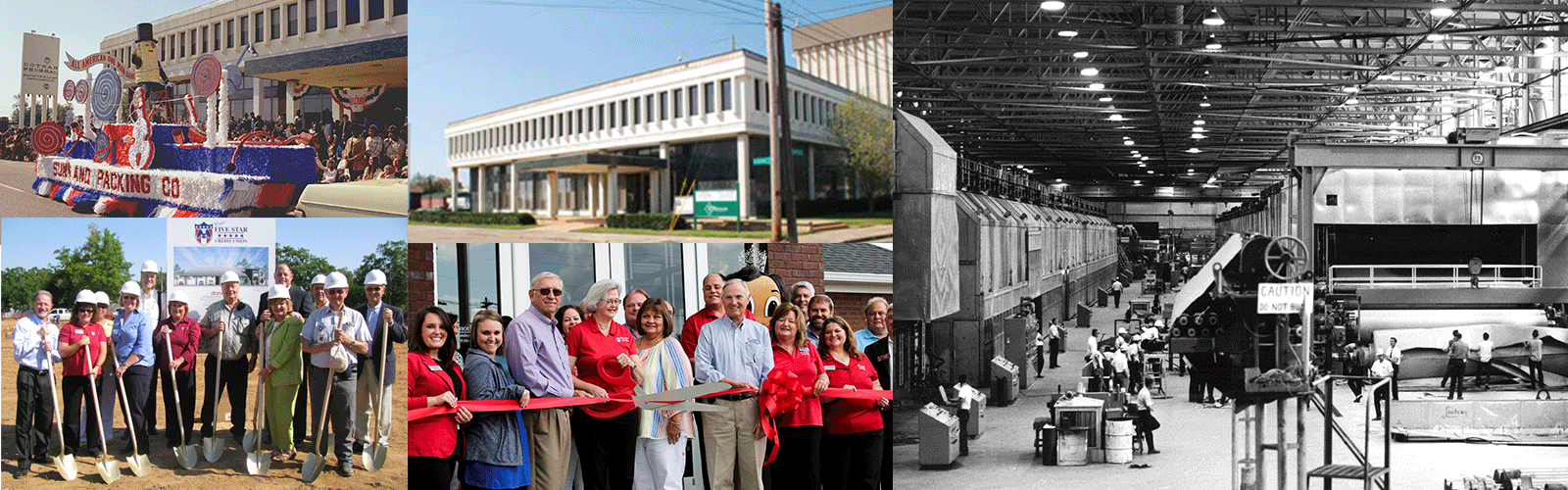

Five Star’s history is rooted in the trees of Alabama and Georgia. The credit union was founded in 1964 in Cedar Springs, GA as the Cedar Springs Federal Credit Union. It was chartered to serve the employees of the Great Southern Paper Company with the first office being a storage closet. The credit union began with eight members who invested $5 each. The credit union was run, part-time, by a mill employee who was known as the treasurer. By the end of the first year, Cedar Springs FCU had 262 members and $81,363 in assets.

The credit union concept caught on in Cedar Springs, over the next 15 years the credit union grew out of the storage closet and opened its first branch on the mill property. Martha Fussell, who was assistant treasurer, was named the first manager of the credit union that now had 3,500 members and $3 million in assets along with seven full time employees. Assets kept climbing as Cedar Springs FCU grew to $9 million in 1984. That same year Earl Griffin was hired as the manager of the credit union and became the president. In 1985, Cedar Springs FCU merged with Engelhard Credit Union. That also brought Cedar Springs FCU’s first branch in Attapulgus.

By the late 1980s, Cedar Springs FCU grew into Dothan with a branch on Ross Clark Circle, as well as a branch in Eufaula. The credit union had $23 million in assets and more than 5,000 members. A second Dothan location was opened in 1991, while also opening a branch in Cairo, GA. With this expansion, the credit union was expanding and that brought a new name, Five Star Federal Credit Union. The new name also brought the familiar logo colors or red, white, and blue, as well as the shield. In 1997, the credit union headquarters were moved to Dothan settling on North Foster Street on land that was formerly the home of William Franklin Newton, Sr., for whom Newton Street is named.

Five Star was growing so quickly in Alabama and Georgia, a community charter was adopted by the board of directors. The community charter opened up membership to more people in both states. By 2000, Five Star had 14,000 members, $70 million in assets, and eight local branches.

In 2007, Five Star hired Robert Steensma as only its third president/CEO. Steensma oversaw more expansion and growth as Frederica Credit Union, with branches in Brunswick and St. Simons Island, GA, merged with Five Star in 2012. This widened Five Star’s footprint to include the east coast of Georgia. In 2014, Five Star became one of the first credit unions to purchase the assets of a bank. Flint River National Bank in Camilla, GA. At the time, Five Star was only the fourth credit union to acquire a bank. Around the same time, Five Star merged with Georgia Coastal Federal Credit Union. Five Star’s branches grew to 11 through the acquisitions.

By 2015, Five Star purchased the assets of Farmer’s State Bank in Georgia. This gave Five Star 15 branches across 18 counties in Alabama and Georgia. In 2019, two branches were built in Dothan and one was built in Blakely. Each has interactive teller machines to help members with their transactions allowing staff to meet the needs of members with more complex transactions. The Five Star Foundation was incorporated in 2020 with the goal of impacting communities through scholarship grants. In 2024, the foundation had endowed scholarships at College of Coastal Georgia, Enterprise State Community College, Southern Regional Technical College, and Wallace Community College, Dothan and Eufaula campuses. Over $400,000 in grants and endowments have been given.

A new headquarters was built in Dothan in 2021. The new space is double the size of the North Foster headquarters building. It houses all of the back office staff. In 2023 more expansion took place. Five Star opened a new financial center in Enterprise; marking the first venture in Coffee County. A new financial center was built on the west side of Dothan in the Lincolnshire area. In 2024, financial centers were opened in Abbeville, AL and Headland, AL. Later in the year, the purchase of two banks, Wilcox County State Bank and OneSouth Bank in Georgia, added eight new financial centers and increased the reach of Five Star in Georgia. It pushed us into new markets like Leesburg, Macon, Ocilla, Rochelle, and Milan. This increased the credit union size to $1.2 billion in assets, 29 financial centers throughout 42 counties, serving 66,000 members.

Throughout its history, Five Star has grown to accommodate more working-class members and ensure many areas have access to financial services. When you join Five Star, you become a member of a credit union that is growing and serving its communities from Dothan to Brunswick and many towns in between. Let's brighten your future.